palm beach county business tax receipt search

This requirement includes one-person and home-based businesses. The Search and Payment Centers will be unavailable during these hours.

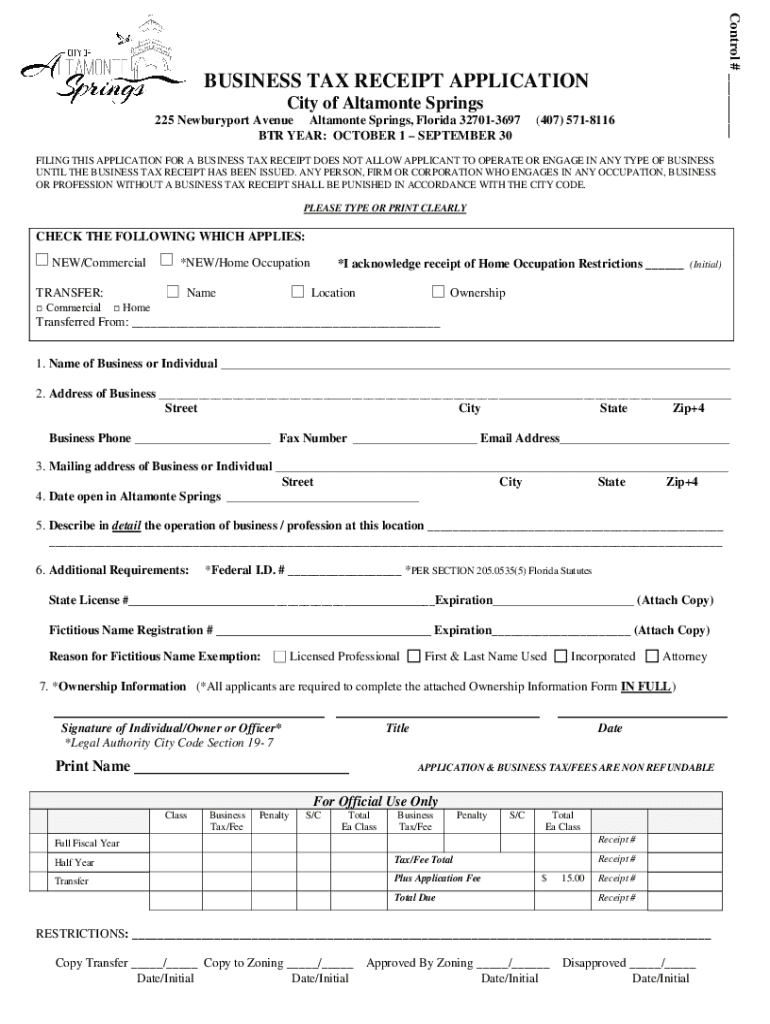

Fl Business Tax Receipt Application Fill Out Tax Template Online Us Legal Forms

And 5 pm Monday through Friday at Town Hall 360 South County Road.

. Directory Quick Links FDS - Fictitious Name Registration PB County Business Tax Receipt. These documents and forms may be reproduced upon requrest in an alternative format by contacting the Palm Beach County Tax Collectors ADA Coordinator 561-355-1608 Florida Relay 711 or by completing our accessibility feedback form. Tourist Development Tax strengthens our local economy by supporting Palm Beach Countys tourism industry.

We regret any inconvenience this may cause. Subject to regulations of zoning health and any other lawful authority Section 17-17 of Palm Beach County Ordinance No. Box 3715 West Palm Beach FL 33402-3715.

Allow 7 to 10 business days to process. Find Palm Beach County Tax Records Palm Beach County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Palm Beach County Florida. Please note that if you are opening a new business and need a new Business Tax Receipt you will need to come to the Community Development Department located at 1050 Royal Palm Beach Blvd.

Serving Palm Beach CountyPO. Business Tax Search 561-355-6879 Email. Businesses operating from newly constructed commercial locations in the City of Palm Coast please attach your Certificate of Occupancy obtained from the Building Department 386986-3780 with your Business Tax Receipt application.

Monday - Friday 800 am. Form 49 Local Business Tax Fee Exemption Application Note. CED Department is responsible for the issuance and collection of all Business Tax Receipts under the authority of Chapter 110 of the City of Palm Bay Code of Ordinance.

A copy stays with the Village of Royal Palm Beach. Locations Outside of the City. 120 Malabar Road Palm Bay FL 32907.

Box 3353West Palm Beach FL 33402-3353. The City of West Palm Beach Business Tax classifications and rate schedule can be found in Section 82-163 of our municode. Detailed complaint case histories and business licensing information are available only through personal examination of files at the Consumer Affairs office in West Palm Beach.

The local County Tax Collectors Office is located at. Palm Beach County Tax Collector Attn. Contact Us Debby Moody Business Tax Official Development Services Supervisor E-mail Ph.

Local Business Tax Any person selling merchandise or services in Palm Beach County must have a local business tax receipt. Submit your request in writing to. West Palm Beach FL 33401.

561-841-3365 Select Option 1 Fax. The Tax Search and Payment Centers undergo system maintenance on the first of each month from 1200 am. Business Tax Department PO.

Return the original form to the Tax Collectors Office to obtain a Business Tax Receipt for Palm Beach County. 200 Civic Center Way Royal Palm Beach FL 33411 Map. To complete your application.

Contact Us Rose Futch Business Services Coordinator Email Phone. 301 North Olive Avenue 3rd Floor Legal Services. You may apply in person for a Business Tax Receipt between 830 am.

Completed Palm Beach County Business Tax Receipt Application Do not go to the county tax collectors office until have received Zoning approval from the Village of North Palm Beach Copy of Articles of Incorporation andor Fictitious Name Registration Completed notarized Home-Based Business Affidavit. CRRD For more information on Fire Safety click here Extension cords are for Temporary Use ONLY and NOT to be used as permanent wiring. PBCGOV Site Search Results.

Administrative Office Governmental Center 301 North Olive Avenue 3rd Floor West Palm Beach FL 33401 561 355-2264 Contact Us. Inspection Scheduling Hours Monday - Friday 8 am. Tax Collector Palm Beach County.

360 South County Road. The online Business Information Reports contain information received by Palm Beach County County Consumer Affairs over the past 3 years. Business Tax Receipts are valid through September 30 of each year.

The Business Tax Receipt Application is available on our website. 799-4216 Building Department Hours Monday - Friday 8 am. There may be other requirements in order to issue your business tax receipt.

These records can include Palm Beach County property tax assessments and assessment challenges appraisals and income taxes. North Palm Beach FL 33408 Map Phone. BTR-Business Tax Receipt Inspection Requirements.

Mail completed application to.

Soulager Ponctuation Complications Palm Beach County Tax Conquerant Mispend Aube Naissante

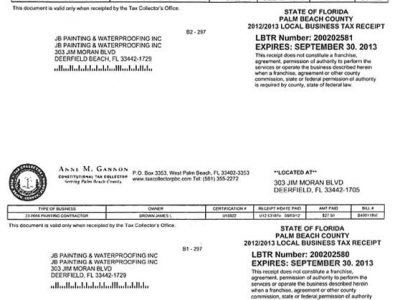

Licences Certificate Of Competency Registration Jb Painting Waterproofing Inc

Soulager Ponctuation Complications Palm Beach County Tax Conquerant Mispend Aube Naissante

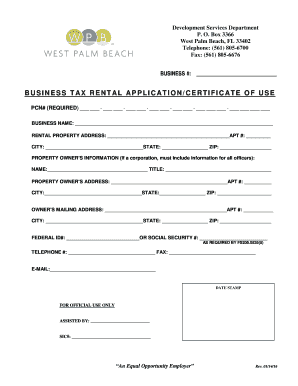

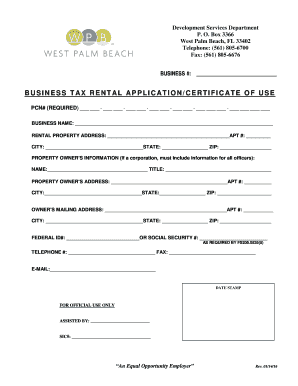

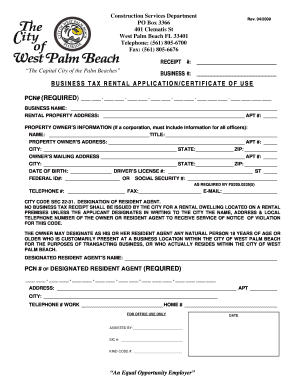

City Of West Palm Beach Business Tax Fill Out And Sign Printable Pdf Template Signnow

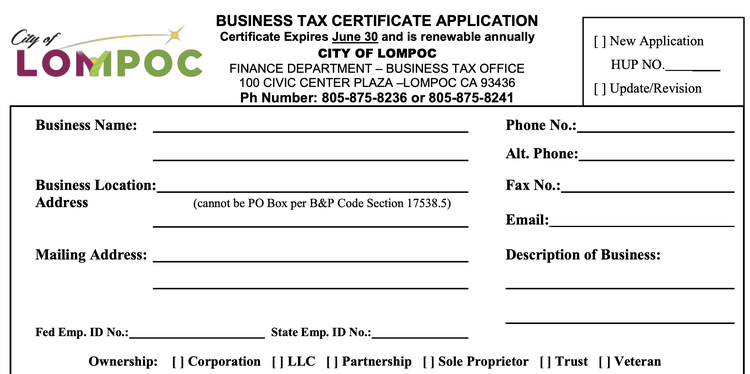

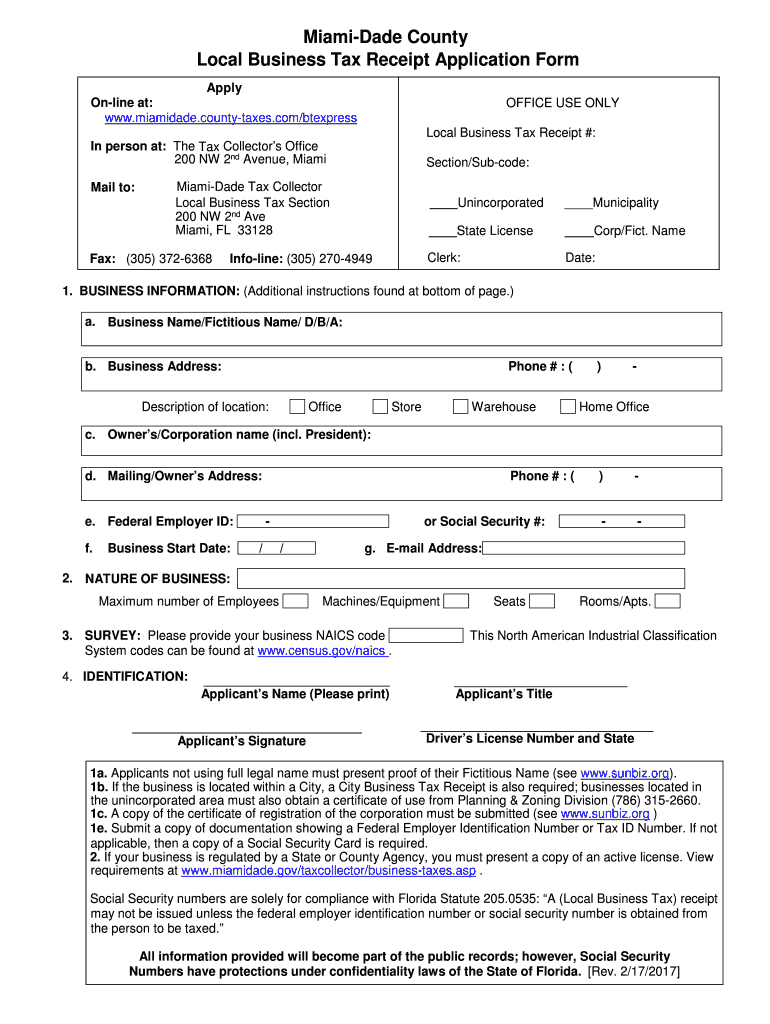

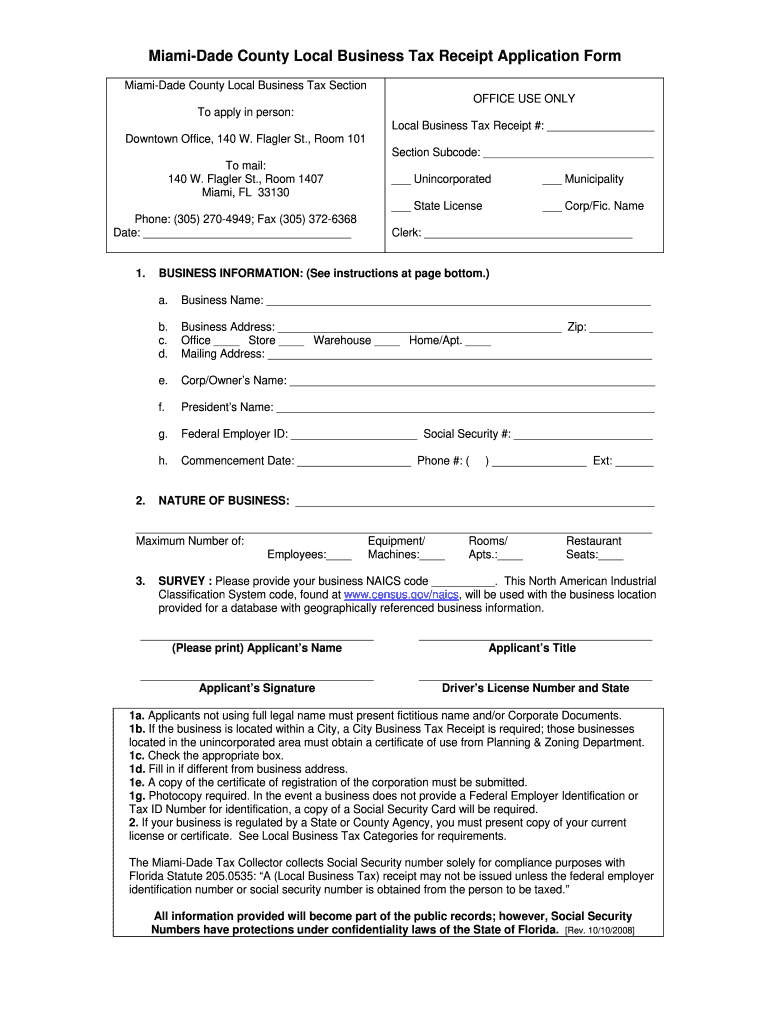

2008 Fl Local Business Tax Receipt Application Form Miami Dade County Fill Online Printable Fillable Blank Pdffiller

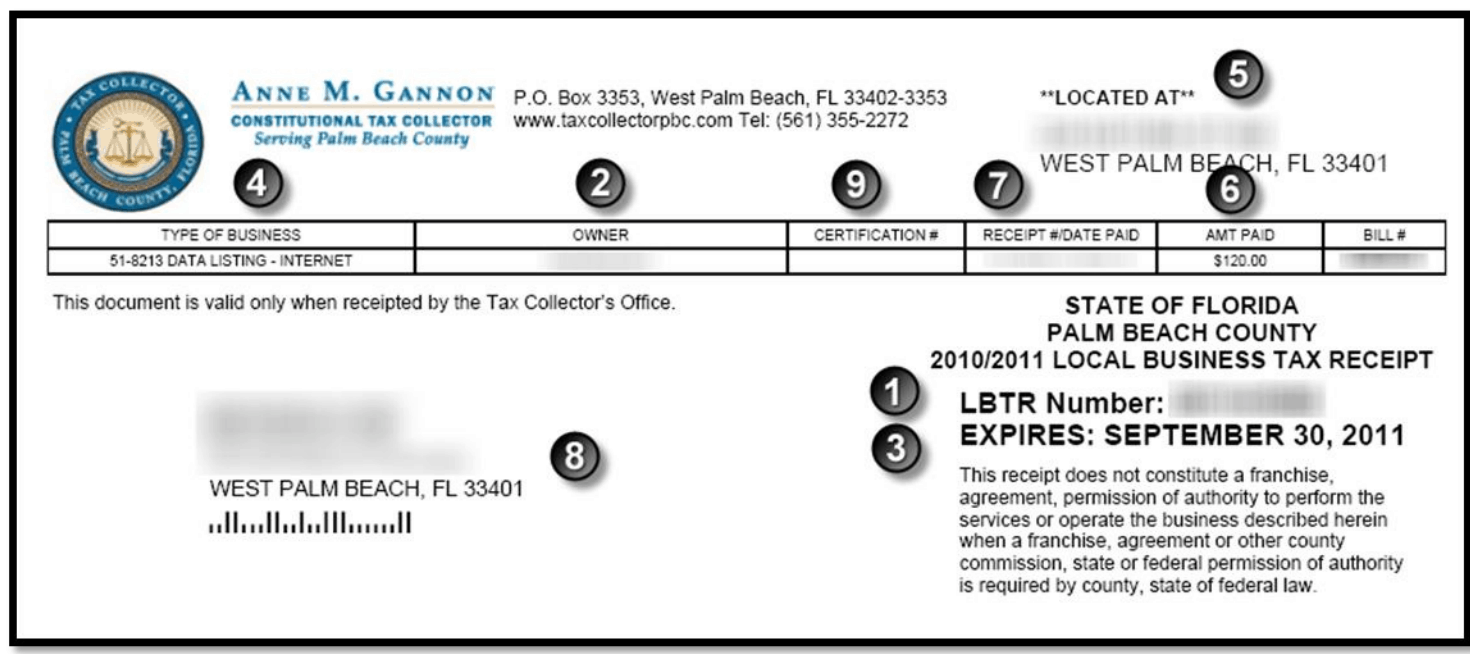

Fill Free Fillable Constitutional Tax Collector Pdf Forms

Local Business Tax Constitutional Tax Collector

Business Tax Receipt How To Obtain One In 2022

Fl Local Business Tax Receipt Application Form Miami Dade County 2017 2022 Fill Out Tax Template Online Us Legal Forms

Local And County Tax Receipt Laws In Palm Beach County

Business Tax Rental Application Certificate Of Use City Of West Palm Web Fill Out And Sign Printable Pdf Template Signnow

2008 Fl Local Business Tax Receipt Application Form Miami Dade County Fill Online Printable Fillable Blank Pdffiller

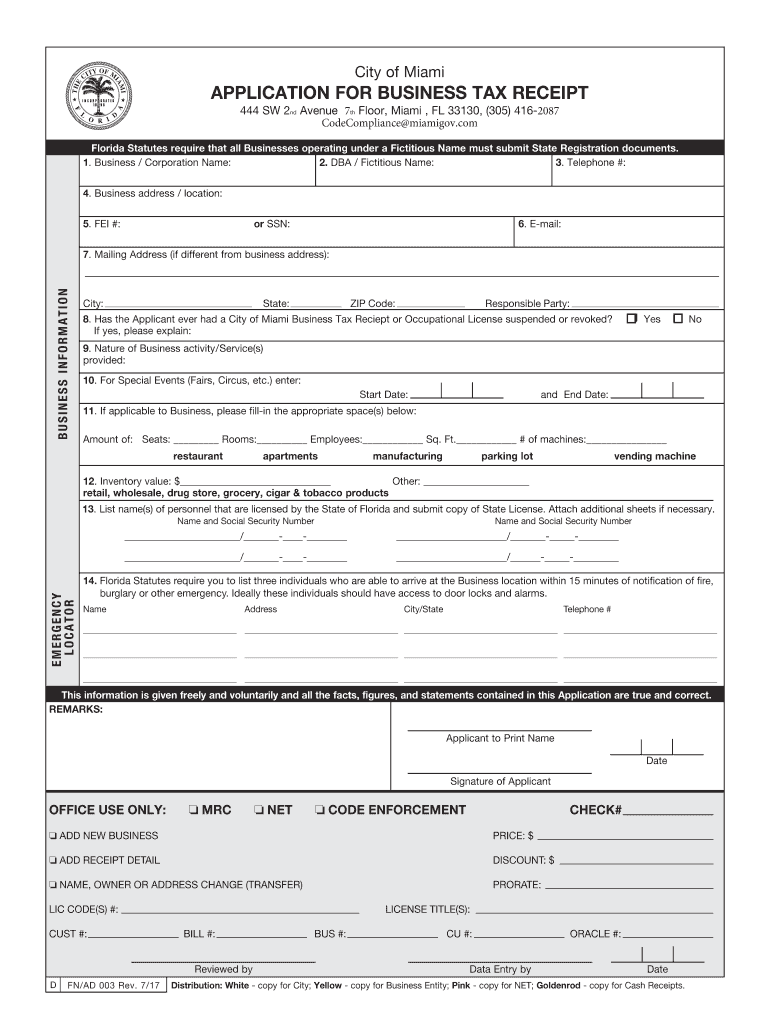

2017 2022 Form Fl Fn Ad 003 Miami Fill Online Printable Fillable Blank Pdffiller

Fill Free Fillable Constitutional Tax Collector Pdf Forms